Money emergencies do not always wait for paperwork and bank queues. Whether it is a medical bill, an urgent repair, or a travel requirement, delays can make a stressful moment even harder. This is where Creditt+ positions itself as an instant answer to your problem.

As an RBI-registered platform, we merge compliance with speed, using AI-driven credit assessment to evaluate applicants in real time. Read this blog to understand how Creditt+ make it happen

Table of Contents

What Are Quick Loans?

Quick loans are short-term, unsecured personal loans designed for emergencies or immediate financial requirements. Unlike traditional bank loans that may take weeks, quick loans focus on how to get loan in minutes with minimal paperwork and fast disbursal.

Key attributes of quick loans include:

- No collateral requirement: You don’t need to pledge property, gold, or fixed deposits.

- Rapid approvals: Funds are often released within minutes of approval.

- Flexible use: Cover anything from medical bills and urgent travel to rental deposits or gadget purchases.

- Minimal documentation: Aadhaar-based KYC and salary proof usually suffice.

Within the broader types of personal loans, quick loans stand out for their speed, accessibility, and suitability during emergencies.

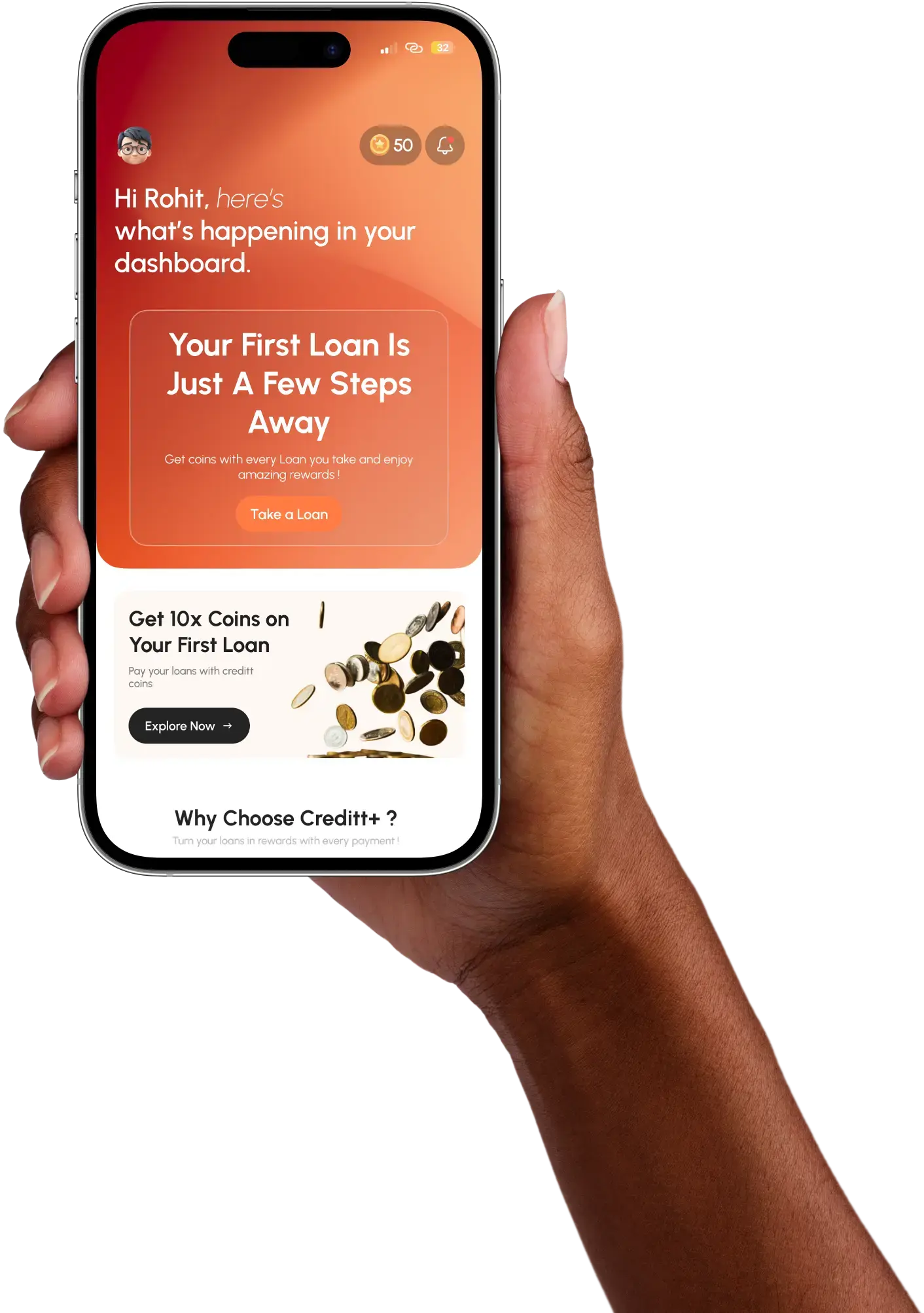

Why Choose Creditt+ for Instant Loans?

Creditt+ differentiates itself from other digital lenders with its AI-driven decision-making and RBI-compliant processes. When you apply for a Creditt instant loan, here’s what makes it reliable:

Proprietary Risk Assessment Model

Creditt+ uses a three-pillar approach:

- Employment & User Background – Evaluates employer type, salary, location, and loan purpose.

- Financial & Bank Data – Reviews balances, transaction history, salary credits, and EMI payments.

- ML-Powered Algorithm – Assesses loan amount requested, repayment behavior, app data, and spending patterns.

This generates a Creditt+ Risk Score, which transparently shows your approved amount, interest rate, fees, and tenure before you commit.

RBI Compliance & Security

Creditt+ partners with NBFCs to ensure all lending activity aligns with RBI regulations, giving borrowers peace of mind.

Fully Digital & Paperless

From application to approval, every step happens through the app or website. No branch visits, no long queues.

Simply put, Creditt+ offers one of the most reliable Instant Personal Loans experiences in India.

Eligibility Criteria & Documents Required for Creditt+ Loans

Understanding eligibility helps you prepare in advance and improves your chances of approval. If you’re searching for how to get quick loans, these are the basics:

- Age: 21–55 years.

- Employment: Must be salaried with at least INR 25,000 monthly income.

- Creditworthiness: Depends on the credit score and credit history of the user.

Documents Needed

- Aadhaar Card for KYC.

- 3-month Salary Record/Receipt

- Online application filled via app or website.

- Recent selfie for identity verification.

Step-by-Step Application Process

For borrowers asking how to get loan in minutes, the Creditt+ process is as streamlined as possible.

- Download the Creditt+ app or visit the official website.

- Complete the online form with personal, employment, and salary details.

- Verify your employment.

- AI-driven evaluation: The system generates your Creditt+ Risk Score instantly.

- Transparent loan offer: View loan amount, tenure, interest, and charges upfront.

- Approval & disbursal: Once accepted, funds reach your bank account within minutes.

- Manage repayments: Track schedules, receive reminders, and use auto-debit for stress-free repayment.

For anyone facing urgent financial pressure, these steps show why Creditt+ is among the most reliable providers of Emergency Loans in India

Benefits of Creditt+ Quick Loans

The real advantage of Creditt+ is quite apparent: fairness and borrower empowerment.

Rapid Approvals

AI-powered decision-making eliminates human delays, ensuring you get approved within minutes.

Customized Loan Amounts & Terms

Loan amounts are matched to your income and financial history, preventing over-borrowing.

No Collateral Required

Being unsecured, these loans are accessible even if you don’t own property or high-value assets.

Full Transparency

Before you commit, you see the loan amount, tenure, interest rate, processing fees, and overdue penalties.

No Hidden Charges

All fees are disclosed upfront, including processing and overdue charges.

Prepayment Benefits

Interest is charged only for the days you actually use the loan. Early repayment saves money with no penalties.

Auto-Debit Facility

Avail yourself of the auto-debit facility at the time of repayment, ensuring timely payment without missing the due date.

Dedicated Customer Support

Support is available all seven days to answer queries and assist with repayment planning.

From tuition support under Loans for Education to sudden home expenses, Creditt+ makes borrowing simple and transparent.

Conclusion

A lending product is only useful if it combines urgency with responsibility. Creditt+ demonstrates that both are possible. By linking interest rates to repayment discipline and debt-service ratios, it rewards borrowers who manage credit well. The platform also ensures that every charge is disclosed upfront.

From loans for women professionals balancing career and family, to loans for education that bridge funding gaps, the application adapts to individual circumstances. What remains constant is the promise: money in minutes when you need it most, supported by systems that safeguard long-term financial health. For those still comparing how to get a loan in minutes across different providers, the distinction is clear.